The United Kingdom is among the most charitable countries in the world. In 2020, around 62% of residents in the UK gave to charities, which amounted to around £11.3 billion. The UK government is trying to make donating to charity easier and more impactful to incentivize people to give more to the causes they care about. Donating to charities is completely free of taxes in the UK. Donations can also exempt you from different taxes and give you tax relief on your income tax.

However, the exact tax benefits of giving to charity depend on several factors. The different means of donations, such as Gift Aid and property donations, give you different tax benefits. Also, many of the standard tax relief policies only apply to sole traders and partnerships. If you’re a limited liability partnership or a limited company, there are different rules for you.

It may prove difficult for you to figure out on your own how best to donate and how to properly apply for tax relief for your donations. We recommend working with a personal tax advisor in London to get the best tax relief benefits on your donations and to make the biggest positive impact on your cause.

In this article, we go over all the four main ways to donate in the UK, i.e., donating through Gift Aid, donating real estate or shares, donating from your income, or donating through your will. We also discuss some of the major causes you might like to donate to. Let’s start with discussing the tax relief rules and terms for the different ways you can donate.

Tax Relief For Different Ways to Donate

As a sole trader or a partnership, you get tax relief for donations to any charity or community amateur sports clubs of your choice. However, there are limitations to where and how much you can donate for different means of donation. It’s important to consider the tax benefits of these ways to donate.

Here, we only go over the basics. A personal tax advisor in London can better explain tax relief for your case and help you make a better choice.

Donating Through Gift Aid

Gift Aid is a scheme by the UK government which allows charities and community amateur sports clubs to claim 25% more on your donation. This means that for every £100 you donate, the charity or community amateur sports clubs get £25 extra from the UK government, totalling £125. This doesn’t cost you in any way.

You can make a declaration for Gift Aid by filing a form. You have to declare all the charities you want your donations to go to. However, some terms may disqualify you from giving or your charity from claiming Gift Aid. Make sure you work with a professional personal tax advisor in London who understands these tax terms.

There’s one important disqualification term that applies to all donations. Your donations must not be four times the amount you paid in taxes in that year. These taxes include income taxes and capital gains taxes. If you regularly support a charity and your taxes decrease to less than four times the donation amount, you must let the charity know.

Gift Aid also makes donations fair and equal for everyone. If you pay taxes higher than the basic tax rate, you can claim the difference between your tax rate and the basic tax rate. If you pay a higher tax rate of 40%, you can claim back 20% of your donations. If you pay an additional tax rate of 45%, you can claim back 25% of your donations.

These tax returns are calculated after including the 25% Gift Aid. So if you pay a higher tax rate of 40% and you donate £100 to a charity, you claim back 20% of £125, which is £25. You can’t claim back the difference if you donate directly from your payroll.

Also, you normally get tax returns when you file your self-assessment tax return for the previous year. However, for Gift Aid, you can claim tax relief for donations you make in the current year. There are rules and exceptions to this. We recommend getting a personal tax advisor in London to find ways to get the highest possible tax benefits for your donations.

Donating Real Estate Or Shares

You can also receive several tax benefits if you donate real estate property or shares to a charity. Giving away your real estate property may be an ideal way to donate to a charity, especially if the charity can use that space. Similarly, donating your good stocks gives your favourite charity a continuous stream of revenue.

You don’t have to pay any tax if you donate land, property, or stocks to a charity. You don’t have to pay taxes even if you sell your property or stocks to a charity. However, you have to sell it at lower than its market value to get the tax benefits. There are strict terms for what qualifies as “lower than market value”. A property tax specialist in London can help you sell your property to help a charity such that you don’t have to pay any taxes.

Donating From Your Income (Payroll Giving)

This is one of the easiest ways to donate to a charity of your choice. Your donation reaches the charity in full, and you never have to apply for any tax returns. However, you cannot donate to community amateur sports clubs this way.

If your employer or pension provider has a Payroll Giving program, you can donate to charities monthly directly from your payroll. The primary tax benefit of this is that the donation is made before income tax is deducted from your payroll. This means that the higher your taxpayer rate is, the less you have to pay for each pound you donate.

At the basic taxpayer rate of 20%, you only have to donate 80p for every £1 made available to the charity. At a higher and additional taxpayer rate of 40% and 45%, you only have to pay 60p and 55p respectively to donate every £1. This is to incentivize high-income citizens to donate more. Still, Gift Aid may be a better way to donate in many cases. Work with your personal tax advisor in London to figure out the best way to donate for you.

Donating Through Your Will

Rather than giving property and shares to charity, many people find it better to donate through their will. If you’re a good trader, you can make good investments with your capital and leave more for the charity of your choice than if you donate now.

If you donate through your will, two things can happen to the properties you leave. Your donation will likely be deducted from the total value of your properties before calculating the inheritance tax. Or, if you leave more than 10% of your property to charities, the inheritance tax rate will be reduced for your other beneficiaries.

You can either donate a fixed amount or some valuable item such as property. You can also donate everything you have left after you’ve given out your other properties to your beneficiaries. However, your will has to be legally viable. Work with an experienced personal tax advisor when planning for inheritance tax in London to ensure most of your belongings go where you want them to.

Best Global and UK-Based Charities To Donate

If you have a philanthropic spirit, but you don’t know where to donate, this section is for you. Here, we talk about some of the most notable global and UK-based organizations working for the greater good.

All of these organizations have implications for people in the UK and the global population in general. All of these organizations are also working to solve some of the biggest problems we face today, so whatever organization you choose, you can rest assured that your donation will be put to good use.

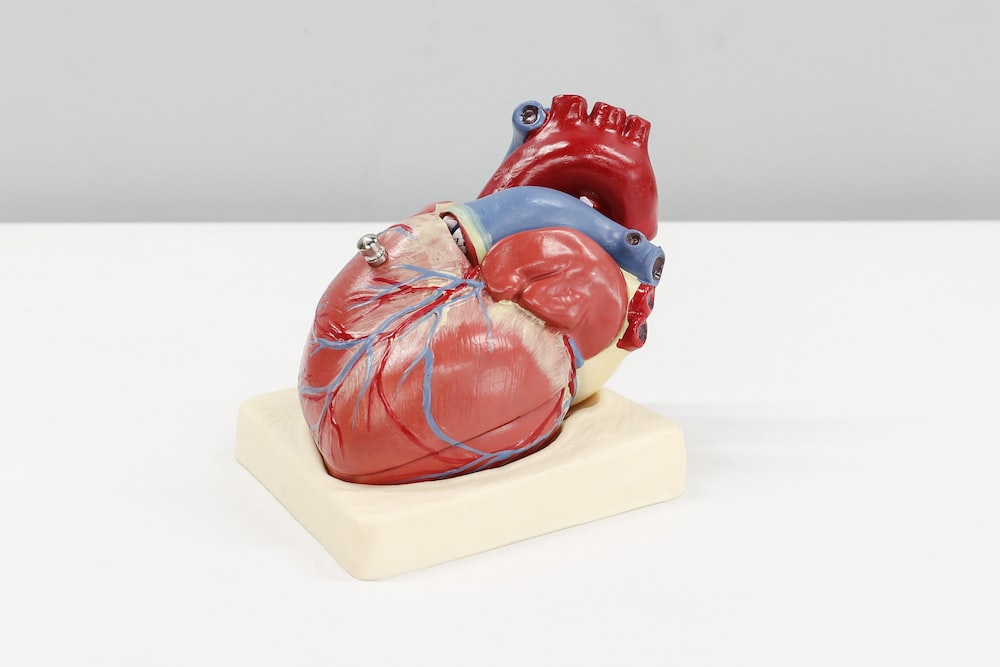

The British Heart Foundation

Heart disease is the number one cause of death globally. It’s also the second biggest cause of death in the UK after Alzheimer’s. High cholesterol and saturated fats in modern diets increase LDL cholesterol in the blood, leading to plaque accumulation in the arteries and causes heart disease.

Medical research has been focused on treating and stabilizing the symptoms of heart disease so far. However, the British Heart Foundation has been working towards treating and curing the root cause to realize its vision of a world free of heart disease.

The organization has played a pivotal role in global heart research. For every £1 donated, the organization makes 70p available for spending on research that can save countless lives globally. Every breakthrough in research made possible through your donations will ease human suffering for generations to come. Work with your personal tax consultant to make sure your donation makes the biggest difference it can.

Save The Children

Founded in the UK in 1919, Save the Children works to save, protect, and improve the lives of children and young people around the world. The organization operates in more than 80 countries and has a unique ability to get to the root of the problem regarding children’s issues. Save the Children is also known for supporting children affected by conflict and disaster.

Your donations to Save the Children will improve the lives of children who need your help the most. The foundation provides education and support to help children overcome the circumstantial disadvantages they face in their societies. They also provide relief to help children and families when disasters like floods and earthquakes strike.

Save Children foundation ensures that 86p out of every £1 you donate goes to help the children while the other 14p is spent on fundraising, management, and other expenses. The organization has been particularly active recently since COVID and inflation has affected hunger-ravaged areas the most. Today might be the best time to donate to Save the Children. Get a tax accountant consultation in London to ensure that your donation makes the biggest possible impact.

Bill & Melinda Gates Foundation

The Bill & Melinda Gates Foundation is one of the largest philanthropic organizations in the world. Over the years, the foundation has invested billions of dollars in innovative ways to improve people’s lives worldwide.

Some of the major programs the foundation has implemented include the Gates Foundation’s Vaccine program, which has helped immunize over a billion people against diseases such as polio. The Bill & Melinda Gates Foundation has also helped control malaria and HIV in the most vulnerable communities. The organization has played a front-line role in minimizing the global health impact of Covid and has committed more than £1.6 billion to the fight.

Scientists and epidemiologists are confident that the globe will face similar—perhaps even deadlier—pandemics in the near future. Bill & Melinda Gates Foundation is one of the leading foundations working toward developing solutions to limit the impact of future pandemics. If you’re someone with respect for humanity and want to see the human race prosper, there’s no better organization for you.

Work With Personal Tax Advisors in London

At IBISS & Co.,we’re the most referred personal tax advisors in London by our satisfied clients. With over 25 years of experience in the industry, we’re the firm you can trust whether you’re looking for property tax accountants or planning for inheritance tax in London. We’re also the proud home to some of the finest business tax accountants in London.

Want to donate to your favourite charity with the best possible tax benefits? Contact us now!